Presenting Brand Heritage: Key Aspects to Pay Attention to

With all the volatility of our current times, brand heritage presents a comforting constant. What can brands do to leverage their history in their marketing?

With the global market volatility of our current times, brand heritage presents a comforting constant. A brand with longevity seems to say, “We have seen this before, and we have gotten through this before.” Nothing sells quite like a story, and brand legacy can be as strong of an asset as a strong product.

With shifting demographics and a growing focus on the Chinese market, the first major economy to emerge from the global COVID-19 outbreak, marketers will have to start catering their marketing to Chinese consumers to make up for their losses in the Western market. According to Bain and Company, in 2019, Chinese citizens make up over 30% of luxury market purchases worldwide, with that number only growing as the Chinese market recovers post-COVID lockdowns.

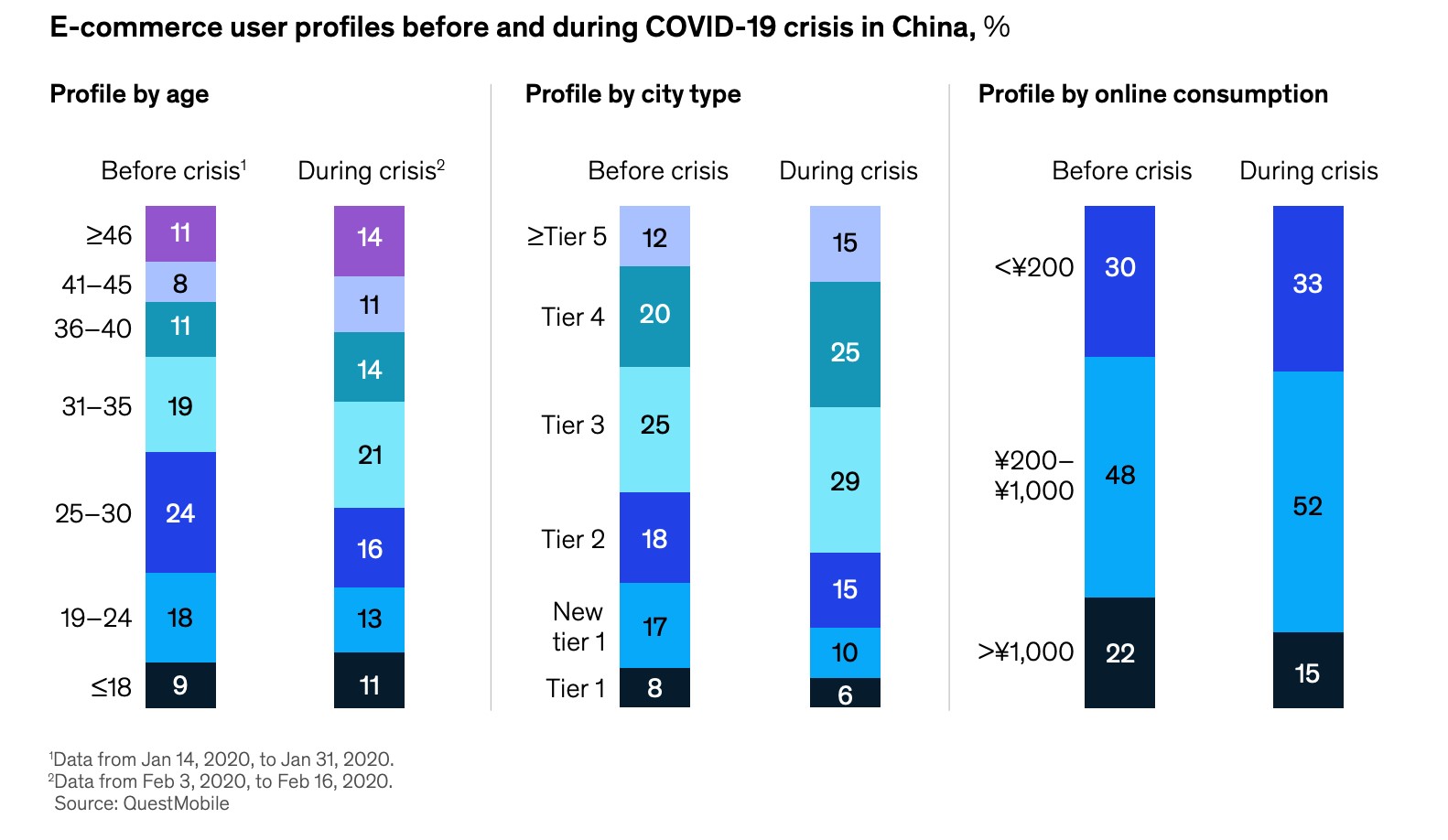

According to McKinsey and Company’s 2019 China Luxury Report, Chinese luxury buyers skew younger, with 79% of annual luxury spending in luxury coming from those born after the 80s in China, and are newer to luxury than their Western counterparts, with half of the post-90s cohort only starting to buy luxury since 2018. Moreover, McKinsey and Company’s China Consumer Report 2021 reveals that Chinese luxury sales through e-commerce have seen a shift towards buyers from lower-tier cities amidst China’s coronavirus lockdown. These cities, typically less cosmopolitan and experienced than their second and first-tier counterparts, will be the new but important territory for luxury brands in the coming years.

Source: McKinsey and Company’s China Consumer Report 2021.

With this in mind, how can brands sell their brand history to a market that, according to the McKinsey and Company report, has a “less nuanced understanding of the heritage upon which the (luxury) market traditionally trades”?

While China’s growth as an economic superpower has been only the last few decades in the making, artisanship and luxury have deep roots in China’s long history as a nation – think of its millennia-long obsessions with fine silk, delicate china, exquisite jade jewelry, and well-aged liquors. The tumult of the first half of the 20th had effectively halted and reset the culture of Chinese luxury and craftsmanship. A few decades after the reform and opening up of China, Chinese consumers are also becoming educated about products and brands rapidly, with a modern revival in appreciation for brand heritage.

Loyalty to classic heritage in the modern age

While heritage and contemporary might seem to be contradictory adjectives, heritage can be understood as brand identity. While integral, a strong identity can adapt to changing conditions without losing what makes it unique. Chinese consumers are after build quality, and the brand narrative is the way to drive that point home. With a premium product, maintaining brand equity back home while conveying the brand narrative to Chinese consumers in a localized tone will allow your brand to stay contemporary while leveraging brand heritage.

Tricker’s is an example of successfully adapting world-class craftsmanship through generations. A heritage leather shoe brand with almost a two-century history, Tricker’s has taken its time improving its materials more sustainable and environment-friendly. Over the past couple of years, Tricker’s have been working alongside Wet-Green and world-renowned German Tannery, Weinheimer, to develop the very best leathers, those suitable to be used on Tricker’s shoes. Wet-Green has developed a special tanning brew using Olives’ leaves; this brew has been patented and is named Olivenleder® (Olive Leather in English). What is unique about Olivenleder® is that it is an entirely organic brew (edible in fact) and therefore extremely clean. All waste can be used as a natural fertilizer, including the leaves and leather shavings.

What is more, Olive leaves are entirely sustainable, a waste product of the Olive Oil industry, millions of which fall during the Olive harvest and are traditionally burnt. The collection of Olivvia shoes continually grow since 2017 as Tricker’s continue to breakthrough, ensuring maximum quality, color, and substance is there. Tricker’s continue to lead in the traceability and sustainability of the materials used to make our shoes and boots. The advances Tricker’s make with Olivvia leather using Olivenleder® are extremely encouraging. It is remarkable something so beautiful can be made entirely using waste matter from the food industry. (Source: trickers.com)

Image: Tricker’s Olivvia Stow Country Boot

Focusing on the Art in Artisanship

Chinese art gallery attendees have become a force to be reckoned with. L Russia’s heritage museums such as Catherine Palace in Tsarskoe Selo near St Petersburg had to be put on red alert for the sheer number of Chinese tourists entering its doors. Pompidou Centre opened in Shanghai last summer as part of France’s cultural diplomacy plans to take advantage of China’s growing interest in art.

Several luxury brands have taken note of and collaborated with art galleries to showcase the artisanship within the white cube to elevate their brand status and educate Chinese audiences on their brand narrative. Brands such as Chanel, Louis Vuitton, and Cartier have all presented their art and craftsmanship in significant galleries in China’s tier-one cities to reach their younger and more culturally savvy audiences.

Instead of collaborating with an art gallery, Prada did something different – they opened their own art space, Prada Rong Zhai. In 2017, Prada renovated a century-old mansion in the heart of Shanghai’s Jing’an district, where they now put on exhibitions curated by Chinese artists. This year, critically acclaimed sixth-generation Chinese filmmaker Jia Zhangke organized an exhibition at Prada Rong Zhai, playing off the homonym o the Chinese character “mian”, which can mean face, noodles, surface, or meeting.

Prada Rong Zhai in Shanghai showcases Prada’s brand heritage to Chinese audiences, bringing Prada’s story of luxury and artisanship to a Shanghai site-specific environment. (images from https://2×4.org/work/prada-rong-zhai/)

Digital can be intimately compatible with heritage

If the Chinese market is any sign to go by, after the COVID-19 global outbreak ends, consumer habits towards digital media interaction will not backslide. Another way of making a brand heritage story relevant is by bringing it into the digital format’s interactivity.

Hermès in China has seen steady growth in sales over the last few years, unaffected by fashion trends. Last year, the brand launched a limited-time exclusive WeChat mini-program, an app within an app, for their prospective clients ahead of their Xiamen store launch. Tying together the Hermès brand heritage with its renowned craftsmanship through an interactive digital format aimed at Chinese digital natives, the campaign represented the new direction for Hermès’ Chinese digital strategy.

Hermès’ WeChat official account has been regularly creating posts tailored for WeChat, marrying content educating followers about brand legacy and craftsmanship with simple gamified UI to attract and incubate the next generation of Chinese luxury consumers.

Hermès’ WeChat post using digital and interactive storytelling techniques to bring to life Hermès’ brand heritage for Chinese audiences

In conclusion, brand heritage is an essential element for luxury brand marketing. Even young markets such as China have started paying attention to heritage, as it serves as a guarantee of quality, something difficult to hold onto in this fast-moving world. Retaining classic heritage quality while innovating the marketing in the target market is the recipe for ensuring your brand is passed down to the next generation.

How Melchers can support foreign businesses in China’s luxury industries

The luxury goods and services market in China is vast and growing. Successfully bringing your brand to China requires cultural sensitivity and careful planning. Market profiling and understanding regional and generational differences are vital to successful access and growth.

Our luxury division focuses on premium brand partners and is able to provide fully integrated retail operation services. We help our selected brand partner understand the Chinese luxury consumer goods retail market, quantifying the scale and the competitor landscape to identify short, mid, and long-term market growth opportunities.

We always proceed carefully, conscientiously, vigilantly, and treat our partner’s brands like our own. Our competencies also include taking over the entire retail operation by ourselves, including inventory management, product repair services, and warranty handling. This emphasizes our perspective on a long-term oriented partnership with shared financial and market risks.

Contact Melchers today for more information about establishing a presence or doing business in China, [email protected].